Introduction

In the high-stakes world of financial services, agility, precision, and transparency are critical for growth. Edelweiss, a leading Indian financial conglomerate with millions of clients, faced significant challenges due to outdated manual operations that slowed decision-making and increased risk exposure. To overcome these hurdles, Edelweiss partnered with Cloudesign to implement a workflow automation software solution built on Microsoft Power Platform.

The Business Challenge: Siloed Operations & Inefficiency

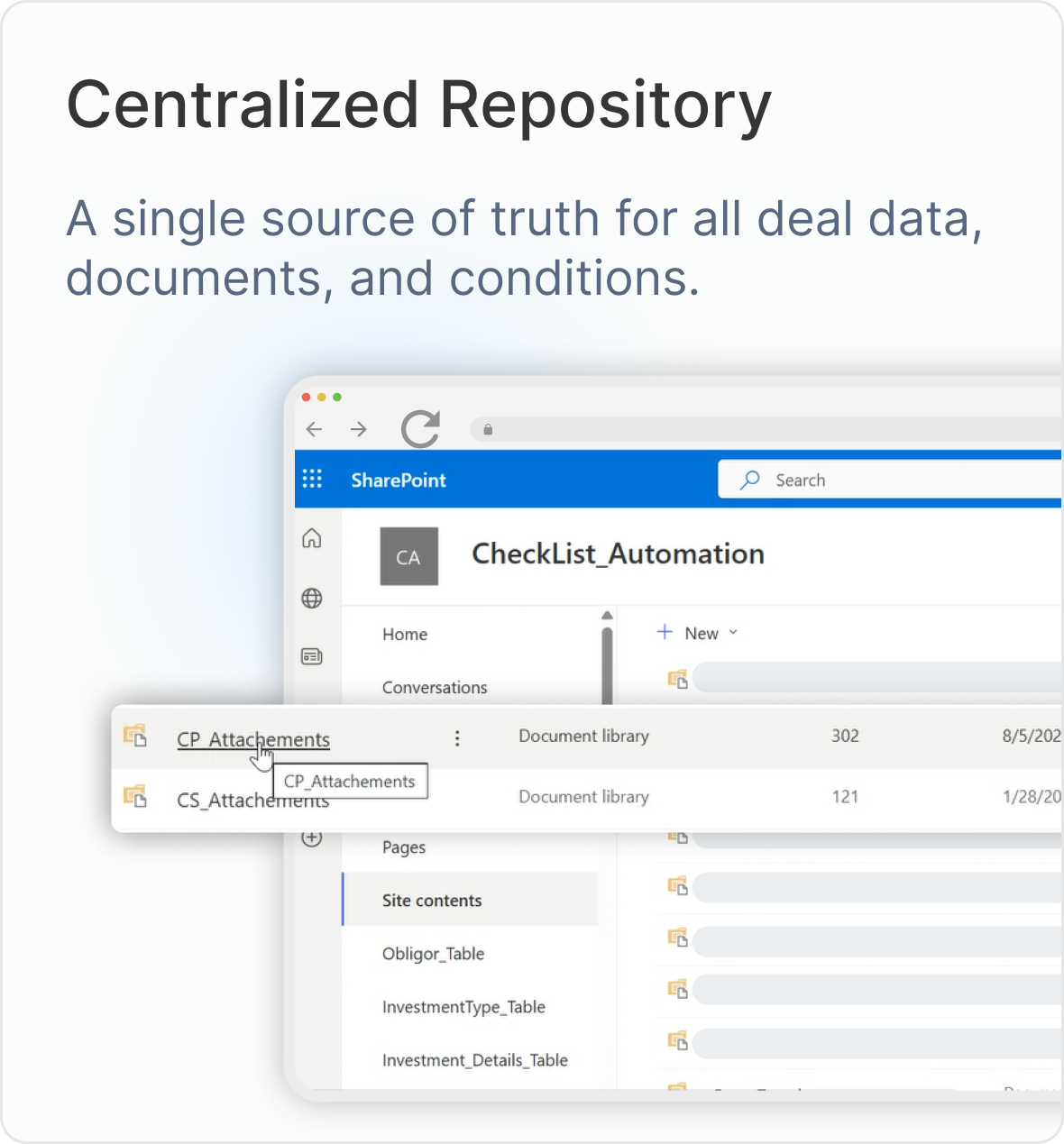

Fragmented Data

Deal information was scattered across Excel sheets and email chains, leading to inconsistencies

Workflow Bottlenecks

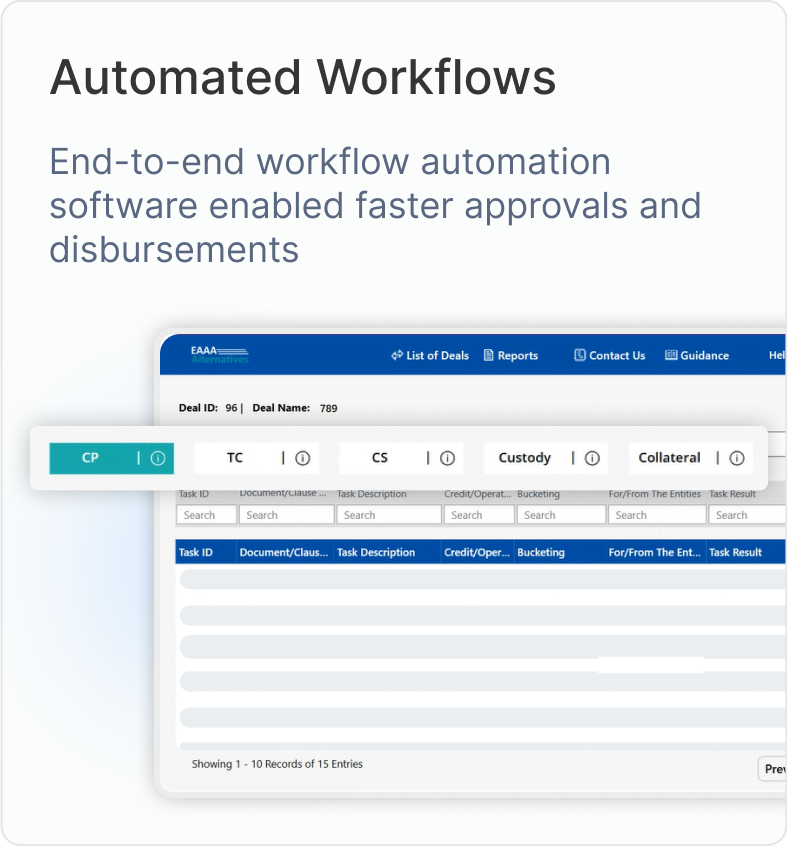

Lack of centralized tracking delayed approvals and disbursements

Manual Inefficiency

Paper-based checklists and document handling consumed valuable time and introduced errors

Weak Risk Oversight

Limited visibility made it difficult to evaluate risks consistently

These inefficiencies slowed growth, reduced productivity, and limited the company’s ability to adapt quickly in a competitive financial market.

The Solution: Custom Power App Solution for Business Process Automation

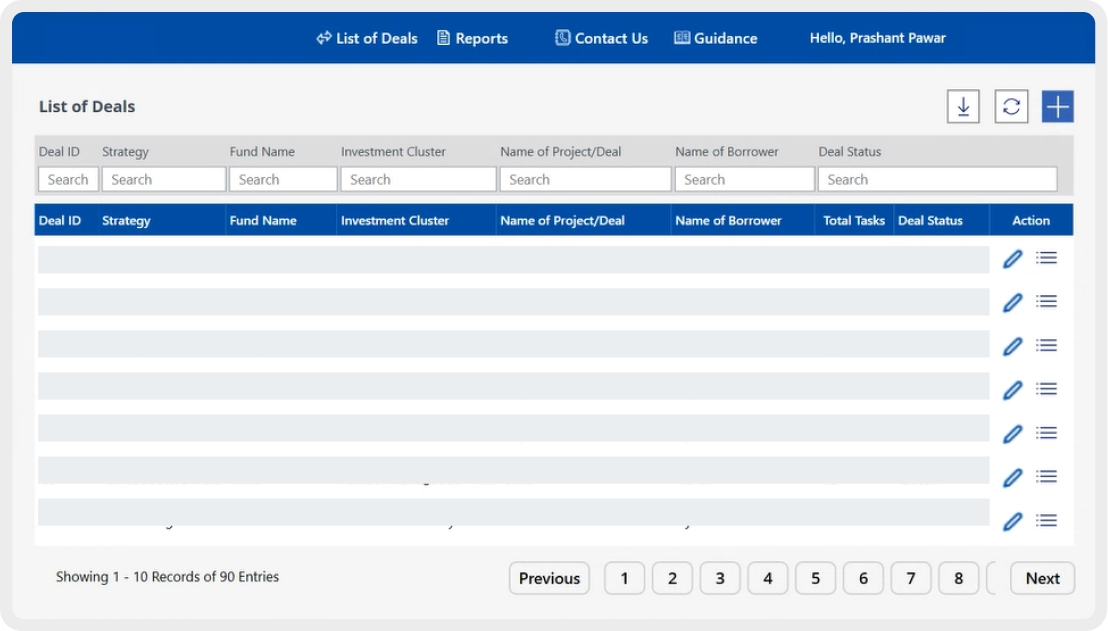

Cloudesign built a custom Power App solution using Microsoft Power Platform to digitize deal management and approvals, acting as a modern CFO checklist powered by business process automation

Solution Architecture: Comprehensive Comparison

Understanding the distinct roles and capabilities of each system component in the workflow

Comparison Factor

Custom Power App

CFO OPS Investment Checklist

Primary Functionality

Manages entire deal lifecycle; initial record-keeping to workflow automation

Specific module/final step for approvals and fund disbursement

Business Purpose

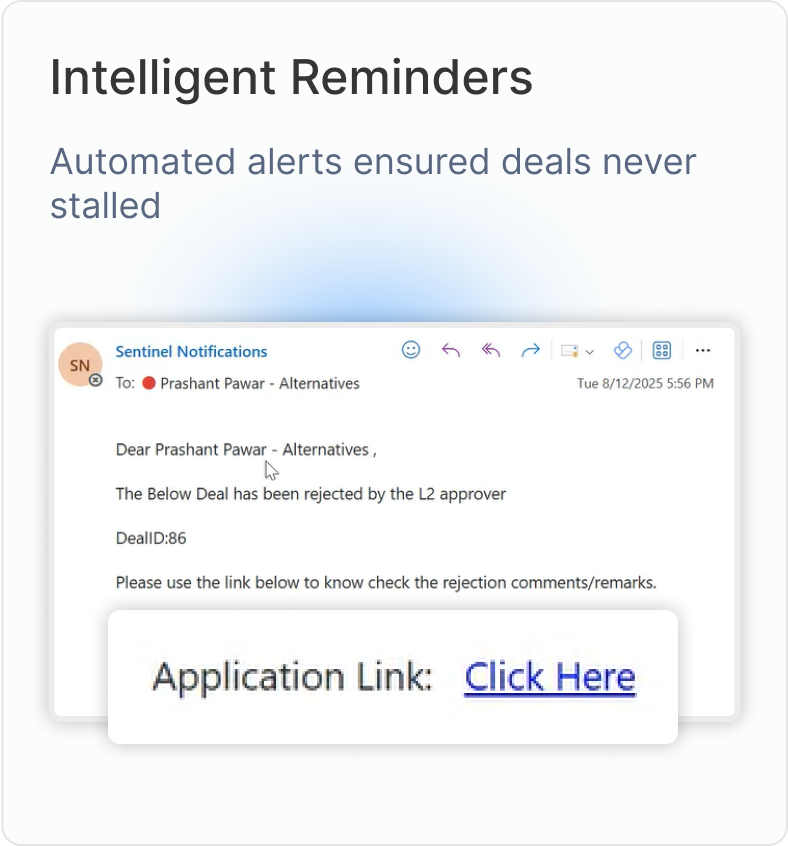

Streamlines and automates comprehensive business processes; ensures smooth info flow and timely notifications

Ensures all deal conditions met before fund release; critical compliance and control point

Operational Scope

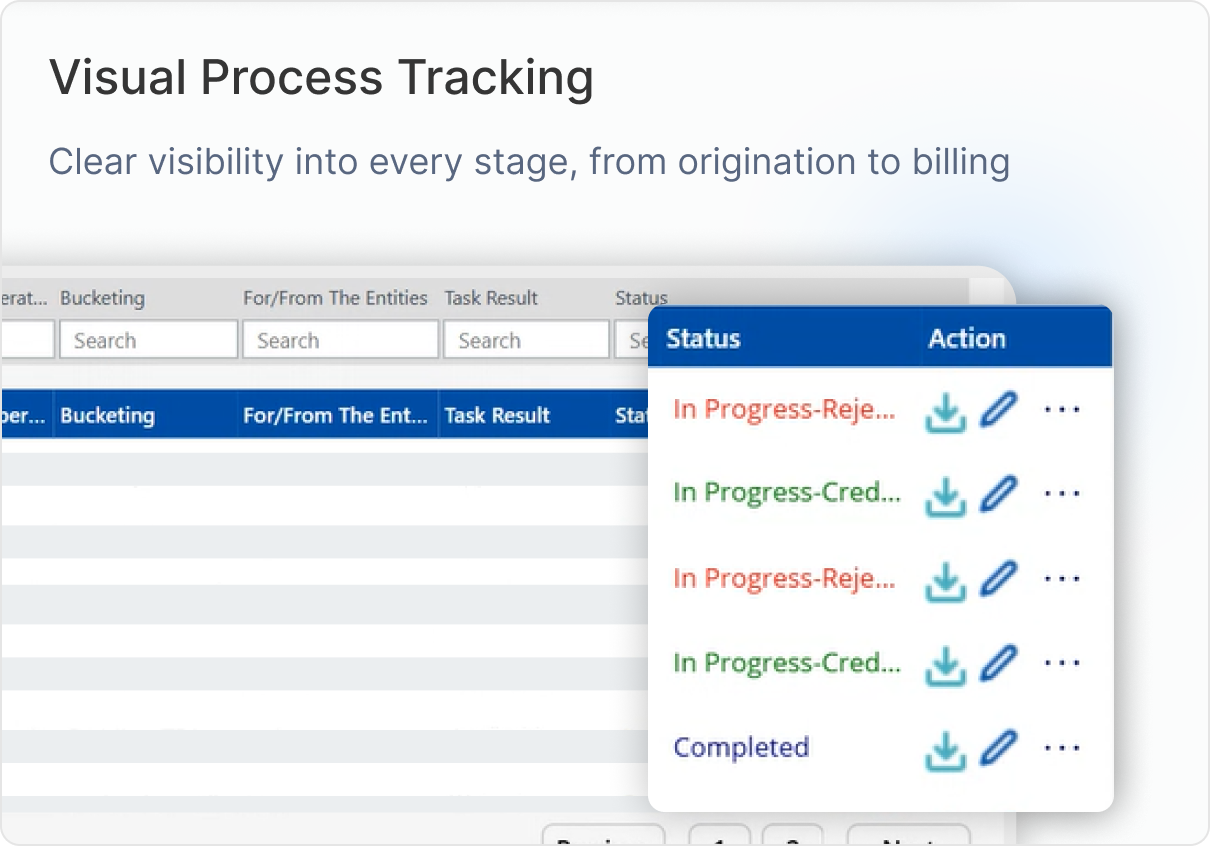

End-to-end solution; stores/tracks thousands of deals and conditions across modules

Narrow focus on final approval and disbursement stage; 360-degree view of relevant reports

Target Users

Used by credit, operations, analysts to create, track, and manage records

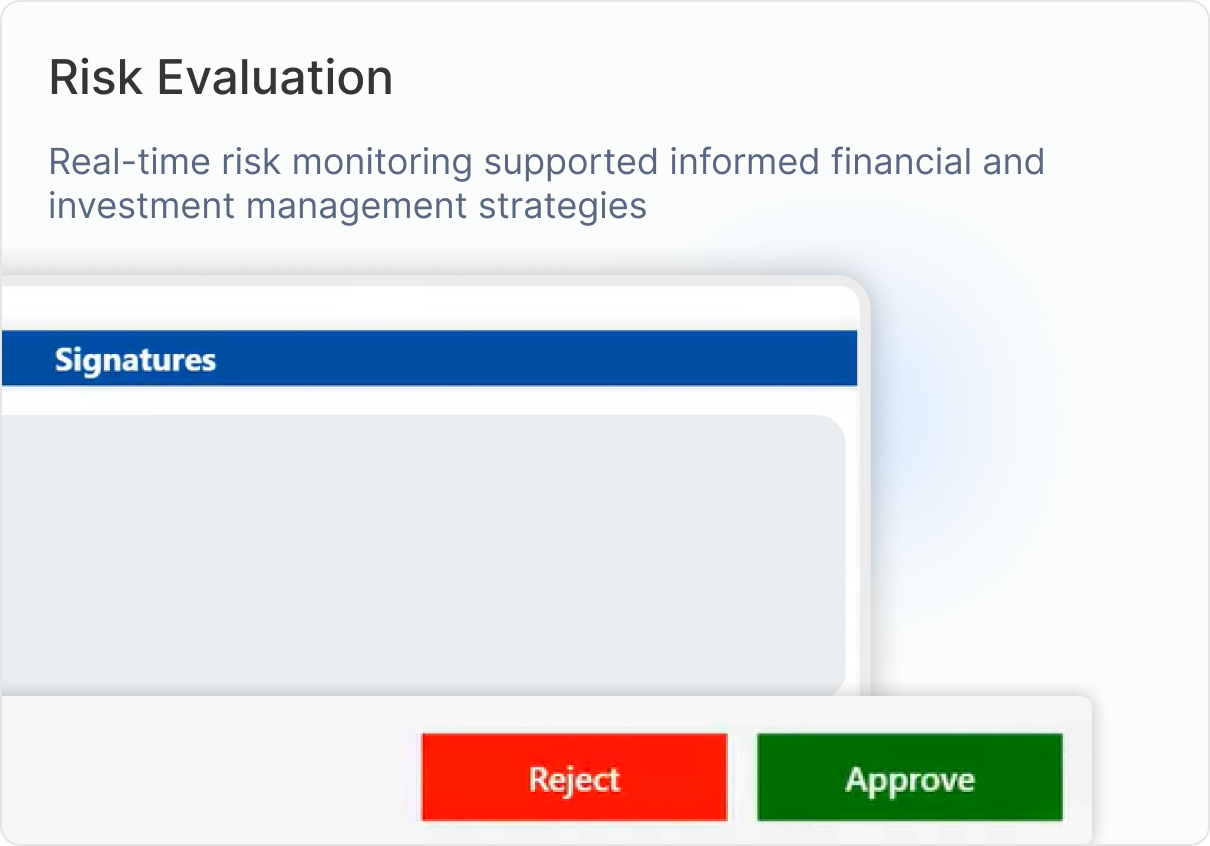

Primarily by CFO and high-level authorities (CEOs) for final approvals and executive sign-offs

System Flexibility

Low-code/no-code; easily customized for specific business needs

Structured approval workflow with standardized processes; less customization

Decision-Making Role

Facilitates collaborative decision-making across multiple teams and departments

CFO approves checklist; then funds disbursed; centralizes final executive decision-making

Key Characteristics

Comprehensive deal lifecycle management Multi-departmental collaboration Customizable workflow automation Real-time tracking and notifications

Executive-level approval control Compliance and audit trail focus Centralized scattered approvals Final disbursement gateway

Business Benefits: Operational Excellence Delivered

The deployment of this financial management software created a measurable impact across Edelweiss’s operations