Launching Big and Bold NFOs at Scale

Bharat Bond

Edelweiss Financial Services is a leading Non-Banking Financial Company based in Mumbai, India. Its extensive financial services portfolio includes asset management of mutual funds, credit financing for retail and corporate entities, asset reconstruction, insurance, wealth management, and other financial services. As of 2023, Edelweiss enjoyed a 2.1 million strong client base that included corporations, institutions, and individuals, and reported a robust annual revenue of 73.05 billion Indian rupees.

Our Specialized Technology Toolkit

Some Critical Limitations of the Existing Platform Suffered

New Fund Offerings (NFOs) are an important service vertical at Edelweiss Financial Services, one of India’s leading NBFCs. The traditional digital platform at Edelweiss already offered an option to subscribe to NFOs. But launching Bharat Bond on this platform was not ideal due to legacy technologies and its inability to handle the expected surge in demand. Furthermore, the old platform was at its capacity, scheduled for phase out and in no position to integrate new offerings.

Inability to handle heavy customer demand

The existing platform used legacy server-side technologies that were resource-intensive and could scale to handle a few hundred customers at its best. But Edelweiss expected thousands of customers at the launch of Bharat Bond and needed a platform that could scale

Difficulty customizing new product launches

Adding new products to the existing platform involved tweaking legacy code. The system was also not fully modular. This resulted in unnecessary downtime during product launches and unpredictable bugs from regression

Outdated User Experience

The legacy platform suffered from slow response times and a sub-standard user experience on mobile devices. Further, the platform required different codebases for the web and mobile resulting in significant costs to the business

Growing maintenance costs

The lack of skilled resources in the market for legacy technologies resulted in increased maintenance costs. Further, tightly coupled modules and lack of automated unit testing significantly increased the costs incurred after every deployment

Unpredictable bugs

The platform also faced unpredictable bugs hampering user experience. Due to the platform’s legacy nature, these bugs were both hard to reproduce and fix

Limited functionality

The dependence on legacy technologies also meant that customers could not be offered the latest functionalities. Failing to offer functionalities ubiquitous on the competition’s platform created a negative brand image in the minds of the customer

Lost opportunities

The substandard experience on the legacy platform was serving as a major deterrent to customer acquisition. This resulted in lost opportunities and reduced ROI

The Hallmark Platform Further Boasted Features

By embracing next-generation disruptive technologies like NodeJS, Angular, and Ionic, a stable and sophisticated platform for the launch of Bharat Bond was created. In line with Edelweiss’s requirements, rapid engineering techniques like DevSecOps development and continuous integration were adopted to deliver the platform in a short span of 2 months.

Rapid response time

Adoption of NodeJs and its single-threaded event loop model allowed the platform to reach breakneck response times on the platform. Customers could view, compare and subscribe to the new fund offerings effortlessly while accessing information in real-time

Multiple platform support

By adapting progressive web technologies and responsive UX design, multiple platform support was made possible with a single code base. Customers could effortlessly subscribe to Bharat Bond over the desktop, android, and iOS platforms

Zero downtime

The platform boasted a modular architecture that minimized system downtime. Newer modules could be continuously integrated without interrupting functionality and customers enjoyed seamless access to the platform

Scale on demand

By adopting cloud computing technologies, the platform could scale to handle thousands of customers at the same time. By scaling as per demand, the platform also reduced overall maintenance costs.

Human-centric UX

Intuitive human-centric user experiences enabled easy navigation. The user experiences followed best-in-class standards and adopted to the platform at hand ensuring a smooth hassle-free user experience. Intuitive interfaces that adapted to the platform at hand Human-centric UI for enhanced customer experiences and easy access to information

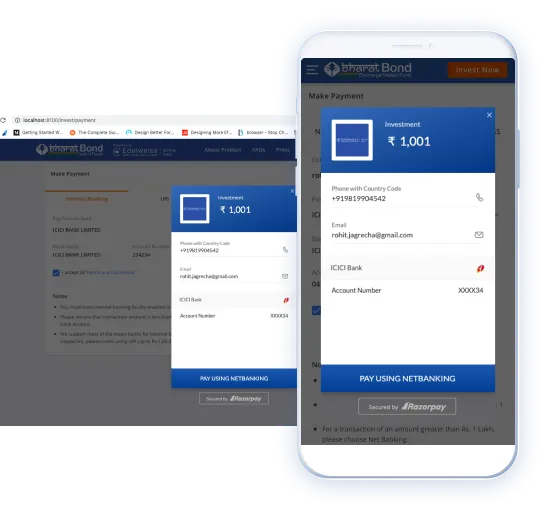

Seamless payment processing

Multiple payment options were integrated into the platform enabling users to subscribe to the NFO with the payment mode of their choice. Easy payments allowed easier conversion and improved user experience

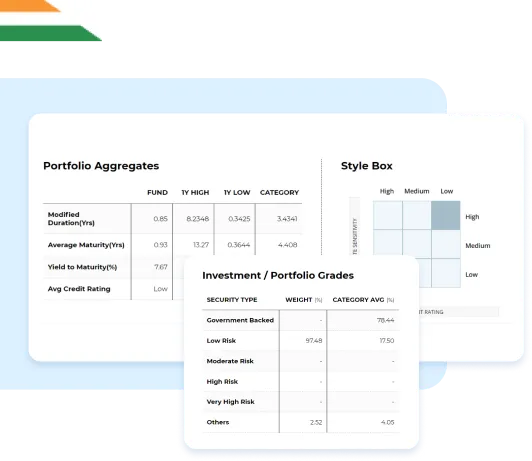

Intelligent reporting solutions

Real-time intelligent reporting kept users up-to-date on the performance of their portfolio and the NFO subscription status. Users could make informed decisions within the platform by assessing the factors like risks, portfolio performance, and more

Backwards compatibility

Integration with legacy systems allowed seamless sharing of information between the NFO solution and the traditional client platform. Edelweiss could take advantage of the capabilities of the new platform and integrate it into the workflow of their traditional platform at the same time

Fully customizable

The platform could also be customized for the launch of any New Fund Offerings (NFOs) in the future. The client benefitted from a dedicated NFO platform that could be reused to the maximum

Along with Creating a Stable NFO Launch Platform for The Future, The Following Business Benefits Accrued

The flawless execution of Bharat Bond within the stipulated time frame of 2 months enabled Edelweiss to capture a significant chunk of the market and reap significant returns on investment.

Largest Debt NFO in India

At Rs

12,000 crores

The base issue

1.8 times

Participation of Retail Investors

55,000

India’s First Listed Corporate Bond ETF, The Cheapest Mutual Fund in India and The Lowest-Cost Debt Fund in The World

65%

Reduction in customer onboarding time

Capacity to handle

Thousands of customers at scale

Drop us a line

Lets Collaborate

ClouDesign Your Digital Ecosystems to Drive Peak Organizational Performance

Your First Consultation is Free!

Send us an email at

sales@cloudesign.com