Managing Returns on Investment Meticulously with

Debt Collector

Edelweiss Financial Services is a leading Non-Banking Financial Company based in Mumbai, India. Its extensive financial services portfolio includes asset management of mutual funds, credit financing for retail/corporate entities, asset reconstruction, insurance, wealth management, and other financial services. As of 2023, Edelweiss enjoyed a 2.1 million strong client base that included corporations, institutions, and individuals and reported a robust Annual Revenue of 73.05 billion Indian rupees.

As a Multinational Financial Services Conglomerate, Edelweiss was Composed of Diverse Subsidiaries.

Each subsidiary boasted financial management expertise across different sectors and industries.

Each subsidiary boasted financial management expertise across different sectors and industries.

These subsidiaries routinely invested client assets in suitable investment vehicles to maximize financial returns. Each subsidiary depended on its expertise to pick specialized investments in line with the risk appetite of its unique customer base.

The result was that Edelweiss Financial Services managed a complex pool of investments through diverse subsidiaries. The investments carried out by each subsidiary were governed by its own set of internal rules and regulations.

The returns generated by these investments needed to be redistributed across these subsidiaries as per the degree of involvement, such as the amount invested, tenure, etc. Manually tracking these returns proved to be a complex, error-prone, and time-consuming process. The client sought to eliminate these inefficiencies by digitizing this process.

Problems with the Existing Business Processes

Previously, the company followed a semi-automated approach to returns redistribution. The investment share of each subsidiary was recorded digitally through an internal online platform. However, tracking the returns on investment and redistributing the investment corpus was a manual affair.

Difficulty Managing ROI

Although investments were recorded digitally, the manual process of calculating returns on investment based on the investment share across subsidiaries involved substantial efforts. Significant manpower was consumed in this process.

Time-consuming Approval Mechanisms

Since the returns were manually calculated, they had to be reviewed for errors and subsequently approved by the officers in charge. The checkers reviewed multiple accounts, which caused inevitable delays in payouts to customers.

Delays in meeting debt collection timelines

Some investment vehicles required timely follow-up to withdraw returns. The inefficiencies of the manual process inevitably led to missing these withdrawal windows and subsequent delays in debt collection.

Investment Redistribution Errors

Despite painful manual tracking, clerical errors concerning investment corpus redistribution crept in. These errors not only caused rework but also resulted in financial losses to the company.

Difficulty Cooperating across Subsidiaries

Errors in investment redistribution across subsidiaries required the involvement of respective subsidiaries to be solved. Achieving this cooperation amidst a fast-paced financial services environment proved challenging.

Inferior Customer Experience

The overall ineffectiveness of this platform resulted in an inferior customer experience that impacted brand loyalty and reduced customer satisfaction.

Decreased employee productivity

The manual and time-consuming nature of this work resulted in decreased employee productivity and reduced work satisfaction.

The New Streamlined Platform Boasted Comprehensive Debt Collection Features

By depending on the reliability of the Dot Net platform and employing the latest trends in front-end development, Cloudesign delivered a cutting-edge digital solution that simplified the debt collection process and eliminated inefficiencies. The new platform was designed keeping the fast pace of financial services in mind. The platform focused on facilitating a simple and seamless debt collection process.

Secure Storage

All transaction details and confidential client information were stored securely and handled by the secure dot net platform. Clients accessed this data via an encrypted HTTPS connection. Thus, all sensitive information was handled according to best-in-class security standards.

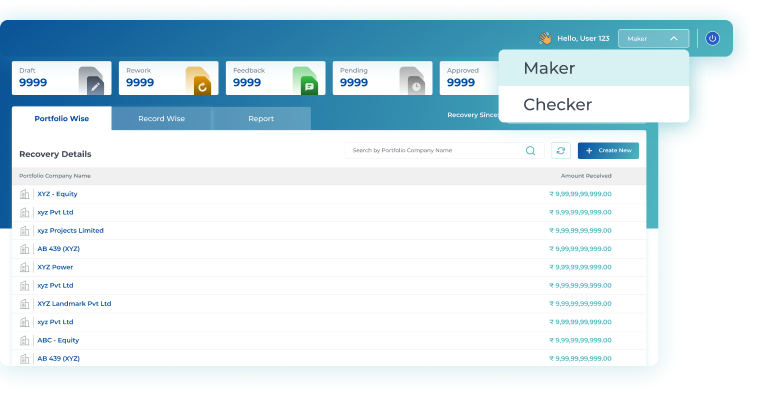

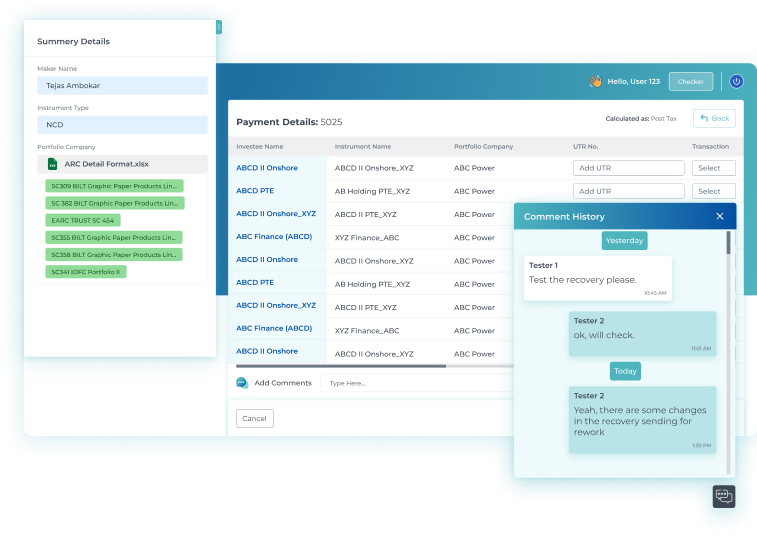

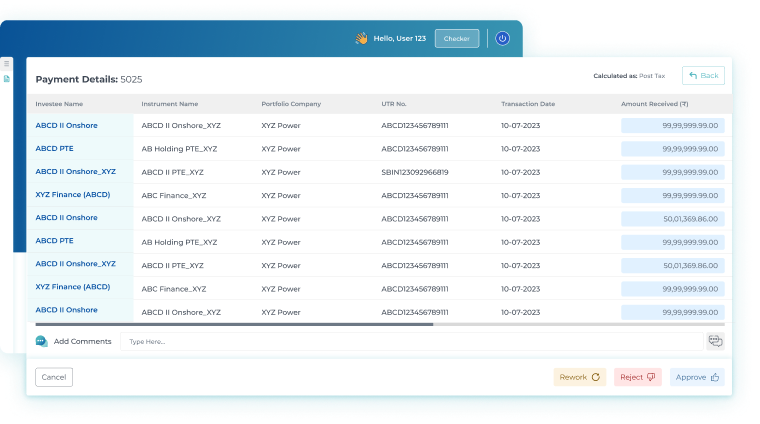

Authentication and Control

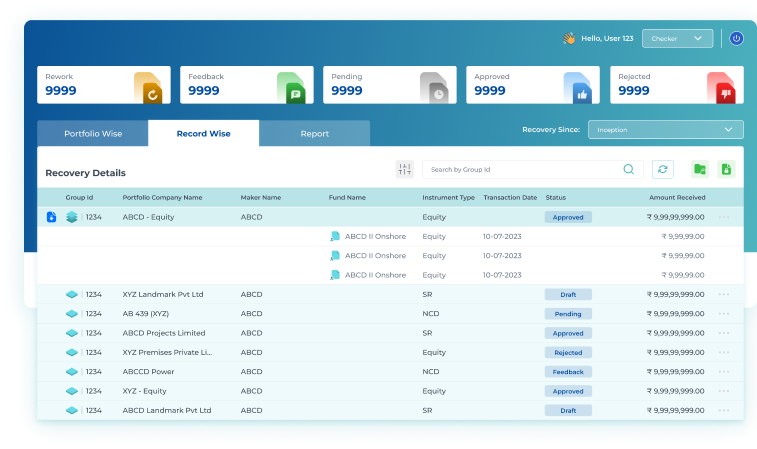

Apart from secure storage, debt collector featured clearly defined roles and permissions that controlled access to the data. Checkers received a higher level of access, and subsidiaries were only privy to their respective client information. With clearly defined access control mechanisms, debt collector streamlined collaboration and increased productivity.

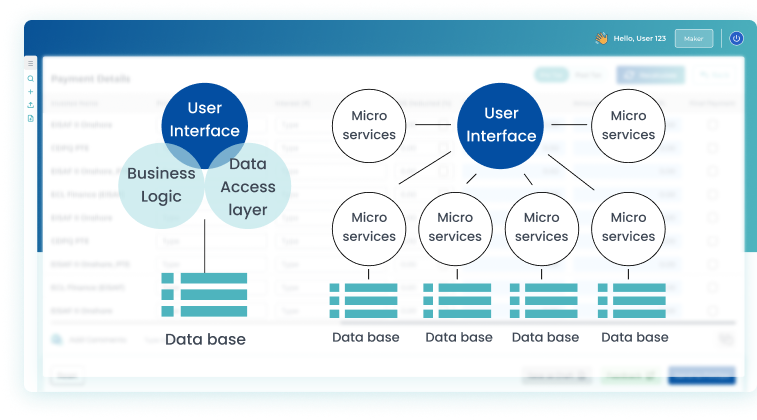

Modular Architecture

Debt collector utilized a micro-services-oriented architecture that was extremely modular. This meant that in the unlikely event of a particular service being unavailable, the platform could still render its services via backup services. The overall resilience of the platform was thus improved.

24*7 Availability

Along with modular architecture, timely backups and other redundancy mechanisms ensured continuous 24*7 availability.

Real-time Notifications

Along with real-time notifications on the platform, users could choose to receive priority notifications via email. Thus, missing debt collection timelines was no longer a concern with notifications that kept the team up-to-speed all the time.

Plug and Play

The platform used an API-first approach and integrated securely with existing in-house systems. Data flow between legacy systems and the debt collection platform was seamless and secure.

Open Banking API

As an added bonus, the new platform supported transactions via the Open Banking API. This enabled seamless transactions with banks and seamless automatic payment validations.

Universal Access

A single codebase and responsive user-interface technologies ensured the platform could be accessed via the web or desktop for a consistent and continuous user experience.

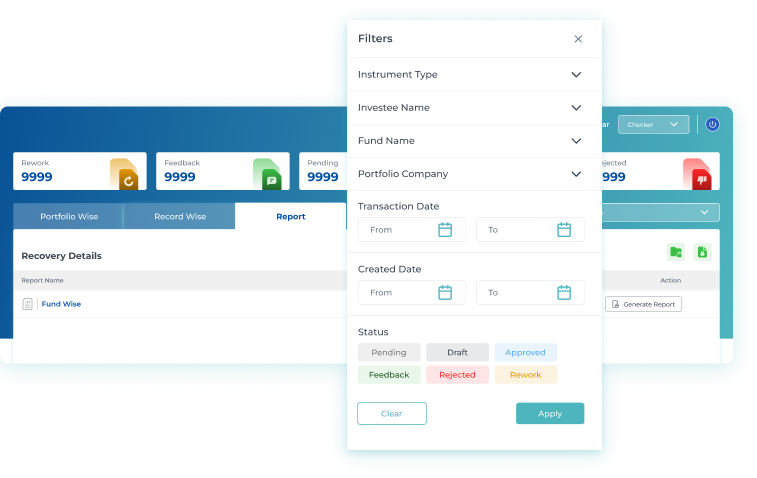

Advanced Filtering and Reporting

Navigating all the complex financial information was made easy via advanced reporting and nifty filters that helped users access the right information at the right time. The reporting module also helped conform to bureaucratic standards by generating reports at the click of a button.

End-to-end Digital Transformation

The entire debt collection process was transformed digitally end-to-end. This new experience resulted in increased user satisfaction and improved employee morale.

The Significant Benefits Accrued by the Business

With the debt collector application, Edelweiss could accurately track investment returns and redistribute them in accordance with corporate policy.

33%

Reduction in the turnaround time (TAT) for withdrawals

100%

Reduction in errors that resulted from manual processing

Increased Efficiency

Better Brand Loyalty

And Improved User Experience

Drop us a line

hire@cloudesign.com

Lets Collaborate

ClouDesign Your Digital Ecosystems to Drive Peak Organizational Performance

Your First Consultation is Free!

Send us an email at

sales@cloudesign.com