Digitizing Mutual Fund Offerings at Scale with

Project

Viraat

Client Introduction

Edelweiss Financial Services is a Leading Non-Banking Financial Company Based in Mumbai, India.

2.1 Million

Strong client base that included corporations, institutions, and individuals

Its extensive financial services portfolio includes asset management of mutual funds, credit financing for retail and corporate entities, asset reconstruction, insurance, wealth management, and other financial services.

73.05 Billion

Indian rupees a robust annual revenue

Our Specialized Technology Toolkit

Business Requirement

Some Significant Problems Posed by the Current Platform

As a leading NBFC providing an extensive portfolio of financial services to its customers, offering unparalleled service quality was important to Edelweiss from the outset.

However, despite its digital capabilities, the existing platform couldn’t effectively meet growing customer demand owing to legacy technologies and evolving business needs.

Inability to cater to growing customer demand

Legacy server technologies were primed to handle a couple hundred customers at the same time. But with growing customer demand and the surge in traffic during occasions like New Fund Offering (NFO)s, Edelweiss needed a system that could handle thousands of online customers at the same time.

Poor customer digital experience

The legacy platform was burdened by slow user interfaces, unpredictable bugs, and poor response time. Overall this contributed to a poor digital experience for the customer and served as a significant roadblock to Edelweiss’s growth.

Growing Cybersecurity concerns

Legacy modules also failed to meet the minimum cybersecurity requirements of today. As a responsible NBFC, Edelweiss was deeply concerned with securing the sensitive financial information of its customers.

Costly system maintenance

Updating and adding capabilities to the existing system was a costly affair due to the lack of skilled resources in the market and the extensive regressive testing mandated by a monolithic architecture. This made developing a new system the more economical option.

Lost business revenue

With the target market being digital savvy, a legacy platform was failing to meet their needs and expectations. This resulted in customer attrition, lost opportunities, and reduced revenue.

Reduced customer satisfaction

The limitations of technology were starting to impact customer experience. Lower customer satisfaction levels were negatively impacting the superior brand value of the client.

To address these issues and deliver on its superior customer experience ambitions, Edelweiss envisioned a capable, cutting-edge, and comprehensive digital platform that could meet all the mutual fund investment needs of its customers.

To address these issues and deliver on its superior customer experience ambitions, Edelweiss envisioned a capable, cutting-edge, and comprehensive digital platform that could meet all the mutual fund investment needs of its customers.

The Solution

Leveraging its In-Depth Experience Developing Fintech Solutions,

Cloudesign Integrated Game-Changing Modules into the Platform

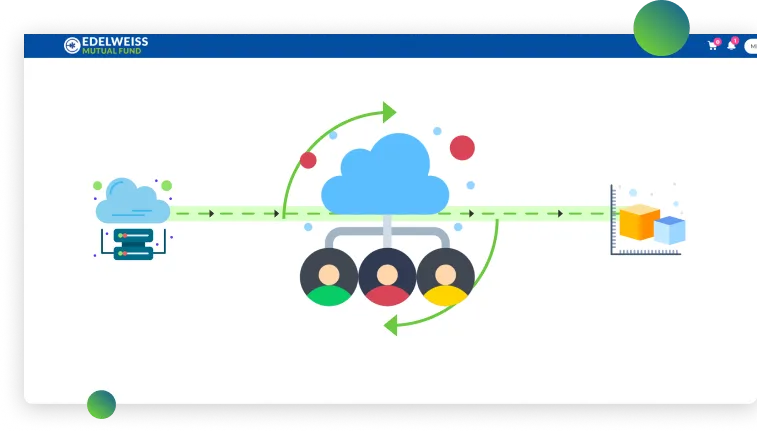

Cloudesign undertook end-to-end digital transformation of the client’s mutual funds platform. By leveraging best-in-class technologies and adopting scalable software engineering practices the future platform was designed to meet Edelweiss’s current and future customer needs.

The new platform enabled complete mutual funds investment and management at one place and was accessible through multiple platforms like the internet, desktop and mobile.

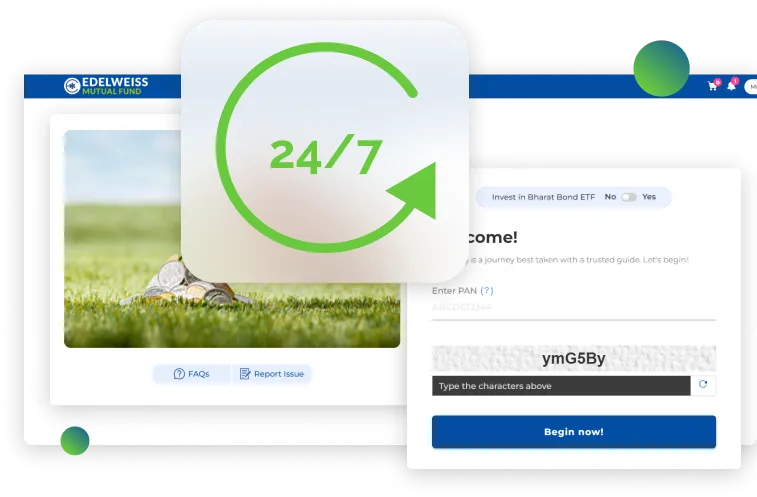

24*7 mutual fund management options

Cloud technologies like Amazon web services were leveraged to provide round-the-clock availability and global accessibility of the platform. This enabled customers to comprehensively manage their portfolios anytime and anywhere.

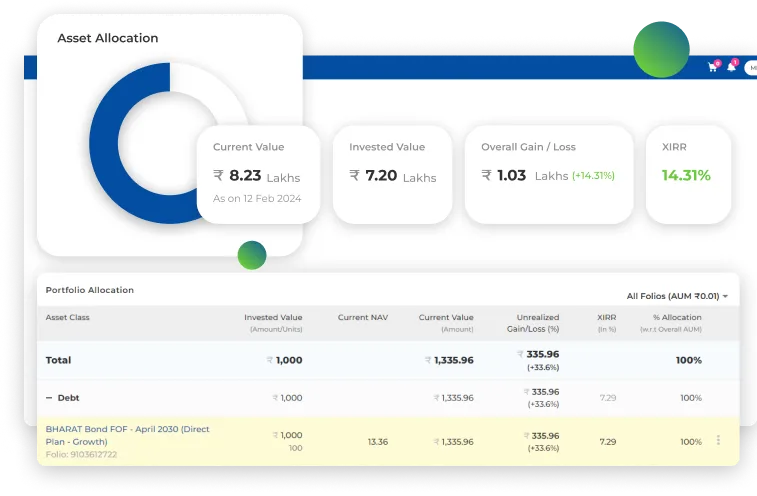

Intelligent reporting solutions

By integrating business intelligence solutions the platform featured intelligent dashboards and interactive portfolio snapshots that enabled quick reviews and more insightful financial decisions.

Complete portfolio management

The latest platform enabled and simplified all aspects of creating and managing a comprehensive financial portfolio. Clients could conveniently carry out asset allocation, diversification, rebalancing, and more through the platform’s sophisticated UX and powerful AI-driven insights.

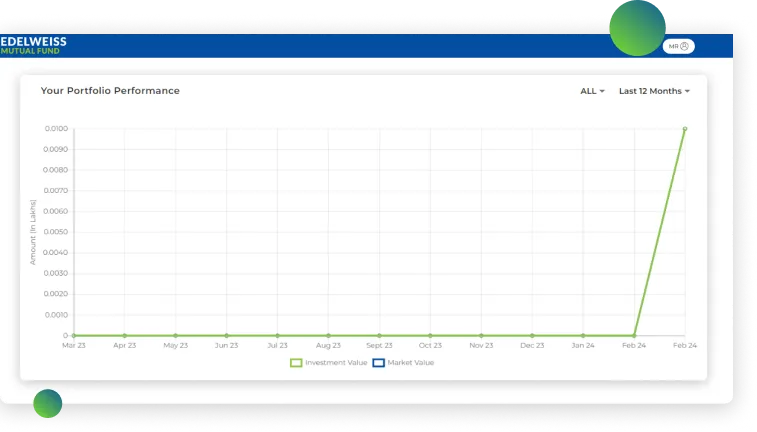

Real-time portfolio performance updates

Integration with stock information APIs enabled access to near real-time financial information within the application. Clients could keep track of portfolio performance and take corrective action enabled by proprietary insights all in one place

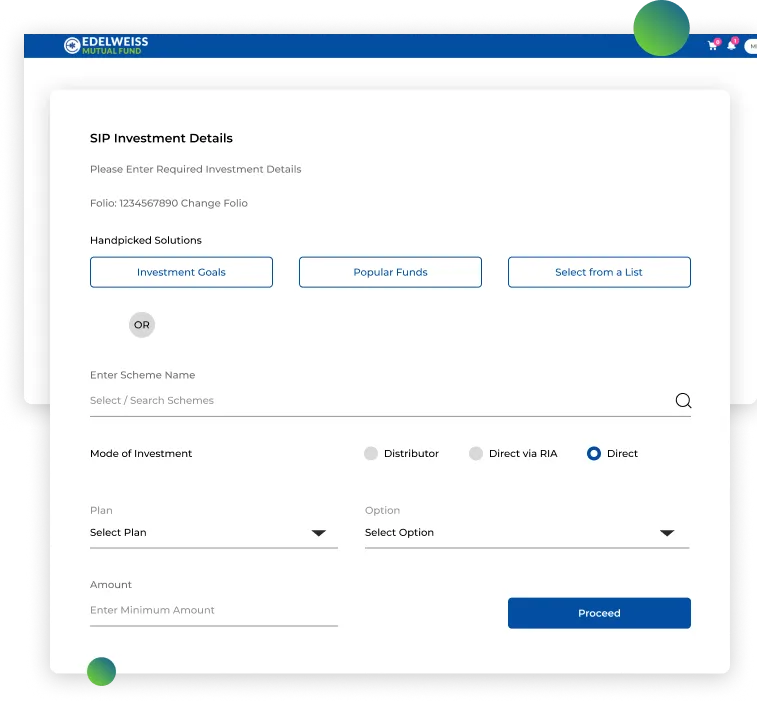

Multiple mutual fund investment solutions

Comprehensive mutual fund investment instruments including systematic investment, systematic transfer, and systematic withdrawal plans and more were featured within the platform making it the go-to choice for the target market.

Flawless execution in line with the brand’s lofty standards

From a smooth and polished UX to intuitive and simplified user workflows, the entire experience was created in line with the brand’s professional standards. By delivering a solution surpassing best-in-industry standards, the new platform helped improve brand perception.

Increased system capacity and continuous availability

Through embracing new-age server technologies, cloud computing solution and nifty server programming, the new platform boasted the ability to handle thousands of customers concurrently, scale as per the demand and deliver continuous services 24*7.

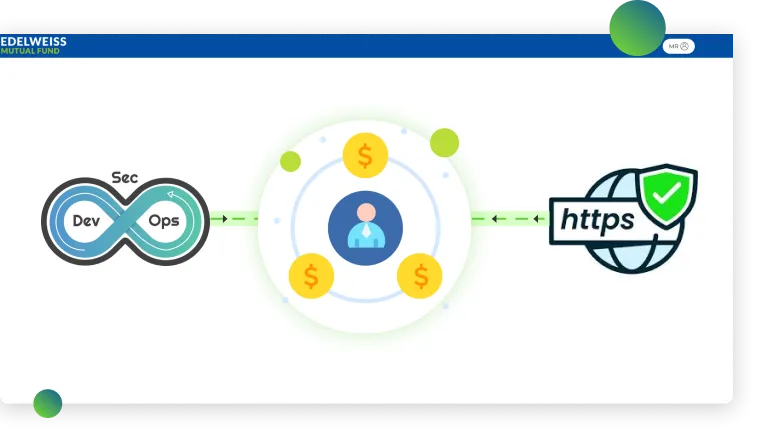

Secured and seamless access to financial information

Along with maintaining a complete history of every customer transaction, the platform enabled secure access to it through the adoption of latest security standards, https encryption, and a DevSecOps approach to development.

Easy and effortless maintenance

Measures like adopting a single codebase to serve multiple platforms, continuous integration and delivery, and a modular microservices architecture enabled effortless maintenance and easy upgrades while ensuring continuous business availability.

Business Benefits

Digitally Transforming its Legacy Mutual Fund Platform

Resulted in Major Business Benefits for Edelweiss. The most Notable of these Benefits were

37%

Reduced time to market for New Fund Offerings (NFO)s

77%

Reduction in the time taken to process mutual fund transactions

23%

Increase in the total revenue generated

250+

Productive employee hours saved every month

Increased

Customer satisfaction

Improved

Employee morale

Drop us a line

hire@cloudesign.com

Lets Collaborate

ClouDesign Your Digital Ecosystems to Drive Peak Organizational Performance

Your First Consultation is Free!

Send us an email at

sales@cloudesign.com