Convenient Corporate Finance with

KODO was started with the mission of simplifying corporate finance and helping businesses grow. Through their products and services, KODO envisioned simpler finance control for businesses that could enable them to cut through financial bureaucracy and simplify corporate expenses and approval. By delivering easy access to liquidity and granular financial control mechanisms, KODO aimed to empower businesses and enable their growth.

Technologies Used

Business Requirement

Credit cards are used ubiquitously within corporations to enhance easy spending and expense reimbursement. While most banks offered ‘specialized’ corporate credit cards, these cards only offered paltry bonuses over average credit cards and did nothing to simplify corporate finance.

Further, businesses incurred significant onboarding delays and bureaucratic hurdles with most corporate banks. These cards were not a viable solution due to reasons like

1.

Cumbersome processing

Most banks required extensive documentation and lengthy procedures to be followed before issuing a corporate credit card. Corporates, on the other hand, needed hassle-free credit card solutions that allowed seamless disbursal, maintenance, and termination of cards to match the ever-changing needs of employees

2.

Lack of control

Corporate cards offered by most banks offered little to no control on expense management. Tracking expenses, approving/rejecting them or deriving cost-saving insights was largely not possible with the limited set of features these cards provided. The result was a complete lack of control over credit card spending

3.

Lack of transparency

With traditional credit cards, spend analysis had to be undertaken manually. The finance department spent a significant amount of time in expense tracking, approvals, and analysis. These manual efforts also led to a complete lack of transparency and zero financial insights

4.

Zero customization

Bank-issued credit cards were too generic and lacked options like custom-spend limits, expense tagging, and others. Naturally most businesses failed to see the value in mass-issued corporate cards with little customization

5.

Paltry benefits

Banks issued generic benefits on corporate cards that seldom matched business needs. The lack of benefits further deterred businesses from embracing credit cards for spending and expense control

6.

Poor finance

Overall, corporate credit cards and their lack of transparency led to poor financial planning and bad spending habits

7.

Limited Liquidity

Businesses avoiding corporate credit cards due to numerous limitations resulted in reduced overall liquidity. This hindered business operations and impacted overall productivity

The Solution

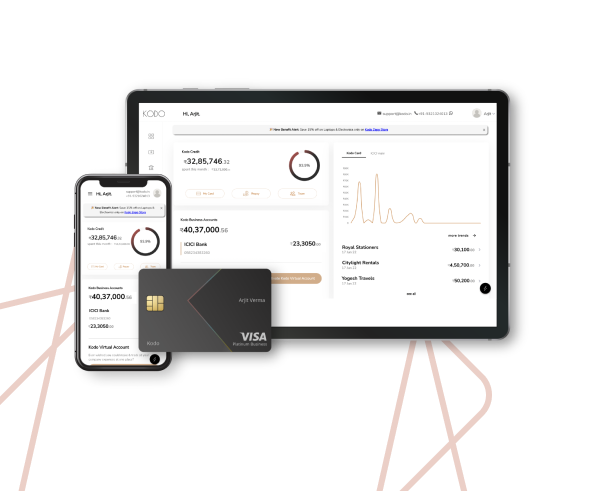

Cloudesign endeavored to create a robust digital platform in line that could support the ambitious product and service offerings that KODO envisioned.

Instant Customer Onboarding

Automatic Account Verifications

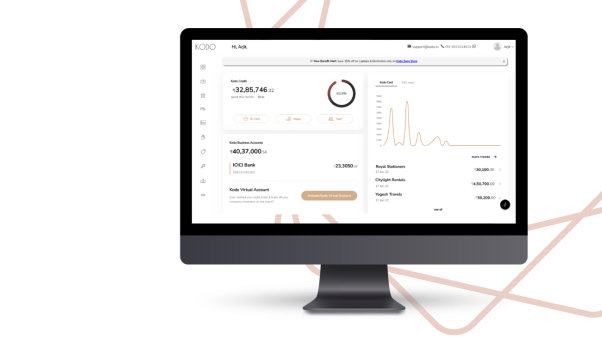

Comprehensive Dashboards

One-stop dashboards enabled businesses to gain a bird's-eye view of their finances. These dashboards enabled spend analysis, expense projections, and advanced data insights that helped clients keep track of the numbers that matter

Comprehensive Dashboards

One-stop dashboards enabled businesses to gain a bird's-eye view of their finances. These dashboards enabled spend analysis, expense projections, and advanced data insights that helped clients keep track of the numbers that matter

GST Integration

Effortless expense approvals

Granular Spend Control

Advanced Filtering

Easy EMI Repayment

Safe and Secure Payments

Comprehensive Reporting

The new platform allowed conversion of big-ticket spends into loans at the click of a button. Businesses were now able to cover unforeseen large-ticket spends and easily repay them in monthly installments

Comprehensive Reporting

The new platform allowed conversion of big-ticket spends into loans at the click of a button. Businesses were now able to cover unforeseen large-ticket spends and easily repay them in monthly installments

Ubiquitous Access

Intelligent Insights

Business Benefits

KODO’s revolutionary digital platform enabled it to break ground in the corporate finance sector and delivered distinct competitive benefits like:

3 minutes

Swift customer onboarding in as little as 3 minutes

20-40%

20-40% reduced business spending for clients

Policy Compliance

Improved financial policy compliance across businesses

Customer Acquisition

Improved customer acquisition & retention at KODO

We’re available for new projects!

Drop us a line at

sales@cloudesign.com

Lets Collaborate

ClouDesign Your Digital Ecosystems to Drive Peak Organizational Performance

Your First Consultation is Free!

Send us an email at

sales@cloudesign.com