Next-Generation Digital Trading with Nuvama Stock Broking

Nuvama Wealth and Investment Limited is an Indian technology driven services company that offers financial services like broking services, depository services, margin trading, and distribution of financial products.

As a leading stock broker and distributor, the company boasted

0.3 million

Active client base

1.5 trillion

INR assets across broking accounts

Technologies Used

Business Requirement

As a digital-first company, Nuvama was an early adopter of technology that provided an easy trading experience through its broking website. But the website was built upon legacy technologies that were fast becoming obsolete. The legacy platform posed significant problems like

A slow and inefficient trading experience

Older technologies posed problems like slower web application loading, irresponsive widgets, screen freezing, lack of browser support, and so on. Overall this negatively affected the trading experience significantly

Delayed server response time delaying demat transactions

Legacy servers used heavy-weight processes to handle user transactions. This resulted in heavy consumption of system resources and translated to higher infrastructure costs

Platform inefficiencies holding back future developments

Most of these legacy systems were no longer compatible with the latest software libraries in the market. Consequently, the system could not exploit the capabilities on end-user devices

Security concerns with legacy technologies

Significant concerns had started to emerge around the security limitations of older technologies. Safeguarding the sensitive financial data of customers was a top priority for Nuvama

A cumbersome customer onboarding experience

The lack of inbuilt identity verification hampered customer onboarding. Customers had to go through multiple forms and submission before onboarding on the platform.

Unplanned system downtime

Unpredictable bugs in legacy code caused unplanned system downtime that impacted the business and negatively impacted ROI

Expensive system maintenance

Any addition or upgrades to the existing system was time-consuming and expensive. Further, there was a lack of skilled force in the market that could handle older technologies

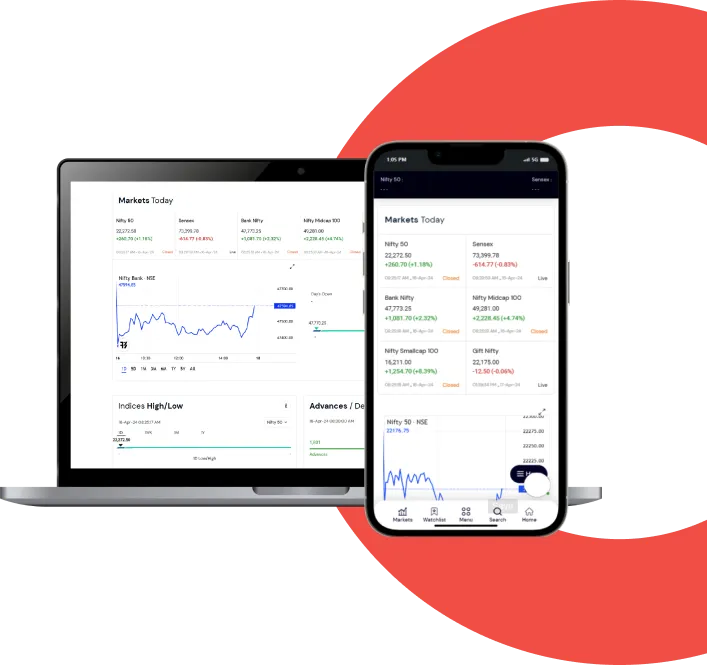

With customer demand growing to thousands of financial transactions each day, Nuvama sought to build a modern trading platform that could scale exponentially and integrate with modern digital markets like the internet, desktop, and mobile.

The Solution

Cloudesign, in collaboration with Nuvama, created a world-class trading platform with industry-redefining capabilities like

Instant demat account openings

Quick customer onboarding was crucial to success in today’s competitive scenario. By doing away with lengthy onboarding and offline requirements, a seamless onboarding module that achieved customer onboarding and demat account opening in under 15 mins was created.

Comprehensive transaction solutions

The platform enabled investment in a wide variety of financial services and investments like stocks, mutual funds, derivatives, commodities, currency, debentures, new fund offerings, and more.

Fixed Income

Bonds

Debentures

Corporate FDs

45 EC Bonds

RBI Bonds

Sovereign Gold Bonds

Capital Markets

Equity

Currency

Commodity

Sub-free infinity

Insurance

Commodity

Sub-free infinity

Managed Portfolio

Alternate investment Funds

Portfolio Management Services

Mutual Funds

ETFs

Structured Products

Proprietary financial insights and training

The platform featured a dedicated module that featured proprietary insights and market research from Nuvama. Investors could also benefit from inhouse trainings delivered via the content module.

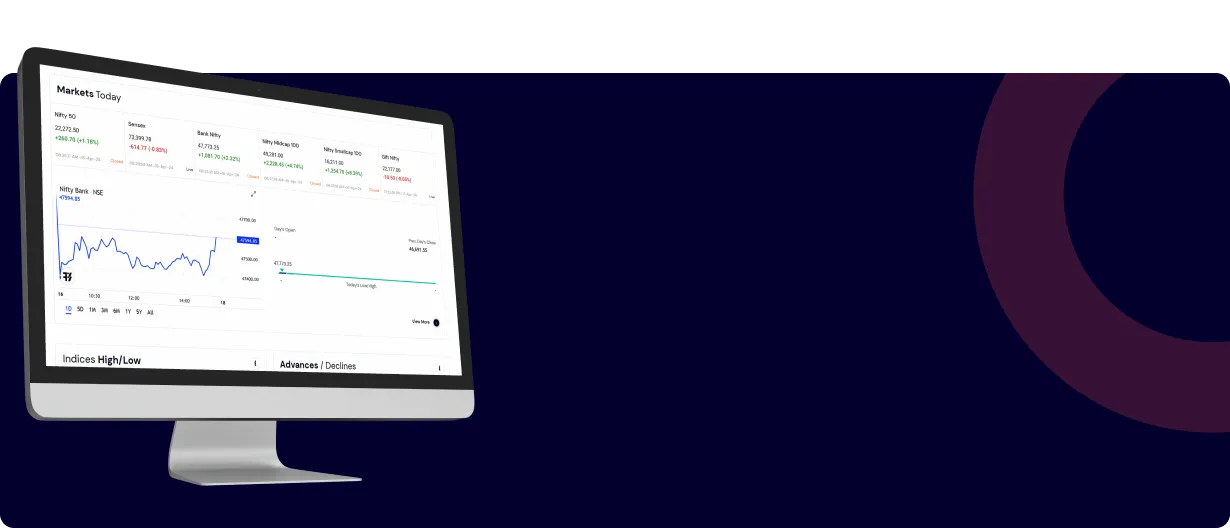

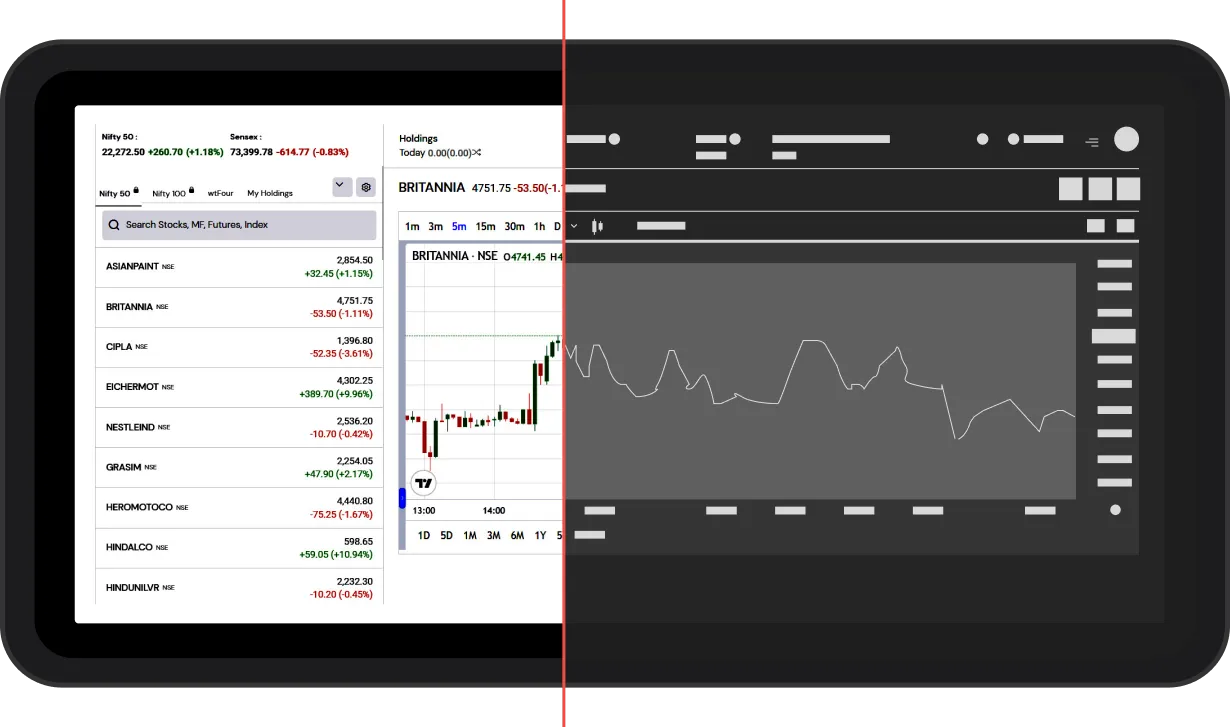

Real-time financial markets information update

By utilizing market-leading stock market APIs, real-time financial information was fetched from stock exchanges like NSE, NASDAQ, BSE, and others. This enabled consumers to make investing decisions with the most up-to-date information at hand.

Blazing-fast demat transactions

Speed of transactions literally translated to financial gains on a trading platform. By leveraging cloud platforms like Amazon AWS and elastic infrastructures that scaled as per customer demand, blazing-fast demat transactions were enabled while optimizing business costs.

Algorithmic trading for advanced investors

The platform added advanced features like algorithmic trading, using SDKs across programming languages, that enabled seasoned investors to define programmatic buy and sell rules and maximize trade profits. The platform supported multiple programming languages and SDKs to enable effortless trading in the client’s language of choice.

Seamless scaling and on-demand load-balancing

By adopting performance-oriented server architectures and leveraging elastic cloud technologies, the system was optimized to scale on-demand and enable exponential growth.

24*7 platform availability

By adopting cloud infrastructure and moving to a modular microservices-oriented ecosystem, platform availability was ensured round-the-clock. Continuous integration and hot deployment techniques were employed to ensure upgrades and fixes could be applied to the system in the shortest possible time frame.

World-class UX

An appealing and intuitive UX in line with Nuvama’s brand philosophy delivered a superior customer experience and uncluttered access to Nuvama’s multiple financial products.

Ubiquitous access

A single-code base utilized progressive web technologies and responsive layouts to allow application access over a wide variety of platforms like the web, desktop, and mobile.

Business Benefits

A 70% improvement

in the platform response time

Improved

SEBI regulatory compliance

4x increase

in transaction volume

Real-time

financial updates

Zero

platform downtime

Improved

customer acquisition

Enhanced

user acquisition and improved brand perception

Lets Collaborate

ClouDesign Your Digital Ecosystems to Drive Peak Organizational Performance

Your First Consultation is Free!

Send us an email at

sales@cloudesign.com